How To Get Rid Of A Repo On Your Credit

Many people detect themselves in a situation where they are unable to make timely payments on their vehicle or car loan. In some cases, the lender will take possession of the vehicle and sell it at auction.

This is chosen repossession, which means that you have lost your car because you've missed payments. It can affect your credit score for years moving forwards, even if yous pay what'south owed and remove the auction from public tape, and so it doesn't prove upwardly anymore. Here's how to keep this serious setback off of your credit study in one case and for all!

How long does a repossession stay on your credit study?

A automobile repossession stays on your credit study for upward to seven years. And so while the bear on lessens over time, it can negatively bear on you the whole time it's on your credit report.

How does a repossession affect my credit score?

Having a repossession on your credit report can be very damaging to your credit score. A repossession may contribute to you non being able to get a loan for things like cars, credit cards, home loans, or annihilation else that requires a credit check. It hurts your credit score for as long every bit the repossession stays on your credit study.

Why practice repos happen?

A automobile repossession typically occurs when you've fallen behind on your auto loan payments.

When y'all go an auto loan, the banking company you have the loan through technically owns the automobile until the loan is paid off in full. If you stop making monthly payments, the bank can substantially take their car back from y'all.

Your lender can seize your vehicle at whatever time once your loan is in default. In nearly states, they don't even need to notify you that they will do this. Lenders will typically and then sell the vehicle to try to recoup the coin they loaned for its purchase.

What if it was a voluntary repossession?

When it comes to your credit, there's little deviation between a voluntary and involuntary repossession. The effects of a voluntary repossession are just as damaging to your credit score.

Can I be sued for the balance of the balance?

In add-on to seizing your vehicle, the lender tin sue you lot for the additional amount they lack to pay off their original investment.

For instance, let'south say you even so owed $fifteen,000 for a auto, and that car got repossessed by the bank. The bank and so sold that car for $10,000. The lender could all the same sue you for the remaining $5,000. The depository financial institution will about certainly sue y'all for the rest; and so, yous will as well accept a judgment on your credit study.

Can a repo exist removed from your credit report?

Yes. Information technology is possible to have a repo removed from your credit report before seven years. You can do i of 2 things:

- Sometimes a bank volition permit you to renegotiate your payment terms so that you can afford to pay them more easily. If you lot can convince them to do this, they volition sometimes remove the repossession for you. Make sure y'all get information technology in writing that they volition delete the repo from your credit report once you accept paid information technology in full.

- Y'all can dispute the the repossession with the credit bureaus.

How to Dispute a Repossession

The Fair Credit Reporting Act (FCRA) requires that negative items on your credit study be accurate and truthful. So if yous can notice errors in the reporting of the repossession on your credit study, yous can accept it completely removed. And the burden of proof is on the credit bureaus.

To remove a repossession, you lot volition need to file a dispute with the credit bureaus. If the lender can't verify that the repo is valid or fails to respond the dispute within 30 days, then they must remove the repossession from your credit written report.

To file a credit bureau dispute, you will first need to get your credit reports. You can get a gratuitous credit report from each of the 3 major credit bureaus at AnnualCreditReport.com.

Once you lot accept your credit reports, you will want to see if information technology'due south reporting on all iii credit reports and then look for whatsoever errors or inaccuracies. You volition and so report the error to the credit bureaus reporting it by filing a dispute. You can do so by phone, postal service, or online. Sending a alphabetic character to each credit bureau is the best way to exercise it.

Can I become a car loan after a repossession?

Yes, however, it's all-time to become the repossession on your credit written report removed before applying for a loan. Unfortunately, very few lenders will requite y'all a car loan with a repo on your credit history.

If they do, the amount of interest you lot'll be paying will be enormous. You may pay 3x to 4x what the machine is worth.

Hiring a Credit Repair Company to Help Your Remove a Repossession from Your Credit Report

A professional credit repair company like Lexington Police force can also assist yous remove negative items like repossessions from your credit report. They have many years of feel helping people, and they make sure the job gets done correctly.

They tin as well assist you potentially remove late payments, charge-offs, collections, judgments, tax liens, foreclosures, and even bankruptcies. If you're tired of dealing with bad credit and are ready to meliorate your credit scores, give them a telephone call!

Lexington Law Customer Testimonials:

I must commend your credit repair company and staff, on doing an exemplary job on my credit history. For the few months that I have been a customer, their reputation represents that of professionalism, courteousness, and people oriented. I am happy with the progress that has been fabricated. Keep upward the great work.

— R.S., Lexington client

— K.L. & B.L., Lexington clientsI am very satisfied with the service you offer your clients. I experience your firm is committed and dedicated to obtaining results. Since becoming a client, I have been astonished by the corporeality of deletions you have been able to obtain for both my hubby and myself.

I would never have been able to reach the results you take on my ain and hold down a total-time job at the aforementioned time. I look forrad to getting your updated emails just to meet how many more negative entries have disappeared.

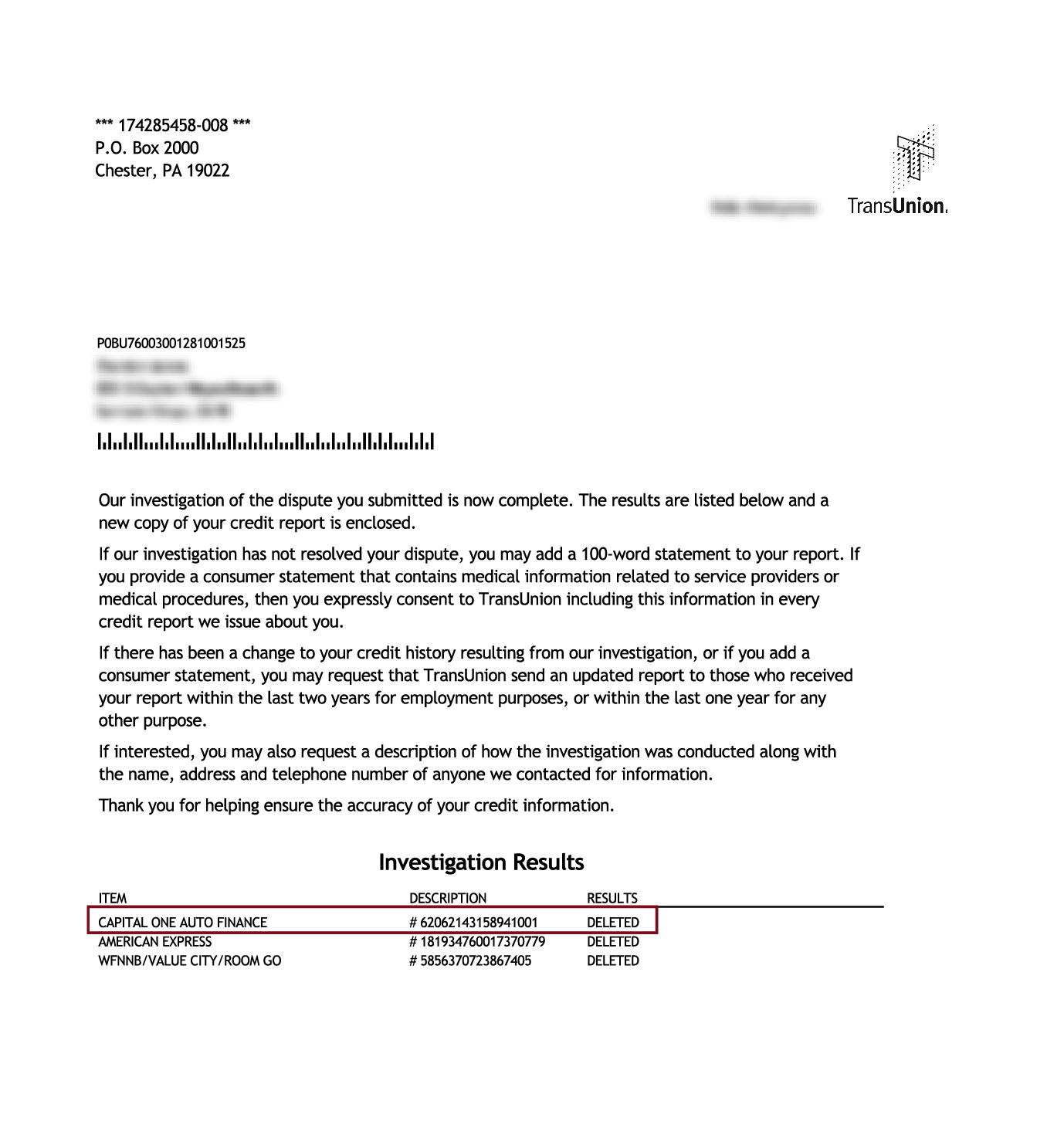

Alphabetic character from Transunion

Discount for Family Members, Couples, and Active Military machine!

Lexington Law is at present offering $l off the initial set up-up fee when you and your spouse or family unit members sign upward for credit repair services together. The 1-time $50.00 discount will be automatically applied to both you and your spouse'southward get-go payment.

Agile military members as well qualify for a one-time $l discount off the initial fee.

Meet the author

Lauren is a Crediful author whose aim is to give readers the financial tools they need to achieve their ain goals in life. She has written on personal finance issues for over six years and holds a Bachelor's caste in Japanese from Georgetown University.

Source: https://www.crediful.com/how-to-remove-repossession-from-credit-report/

0 Response to "How To Get Rid Of A Repo On Your Credit"

Post a Comment